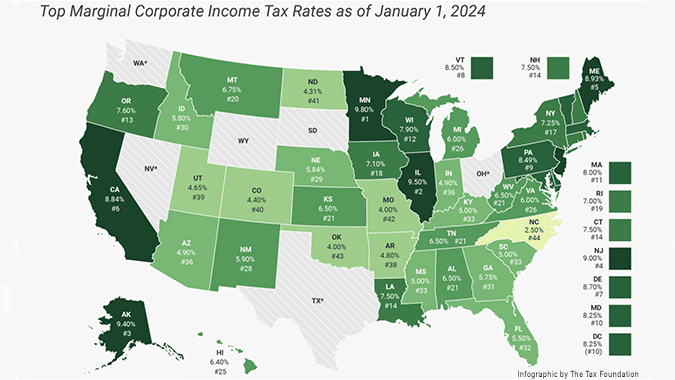

Company Income Tax Rate 2024 – She has spent the last year and a half working at a software company, managing content about CRMs who make $1,500 or more throughout the year. The FUTA tax rate is 6% on the first $7,000 in income . For the 2024 tax year, six states are making changes to the top marginal rate for corporate income tax. In all cases, corporations will be able to take advantage of a reduction in the rate. Scroll .

Company Income Tax Rate 2024

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

Source : itrfoundation.org2024 State Corporate Income Tax Rates & Brackets

Source : taxfoundation.orgWhich States Have the Highest Corporate Taxes in 2024? NJBIA

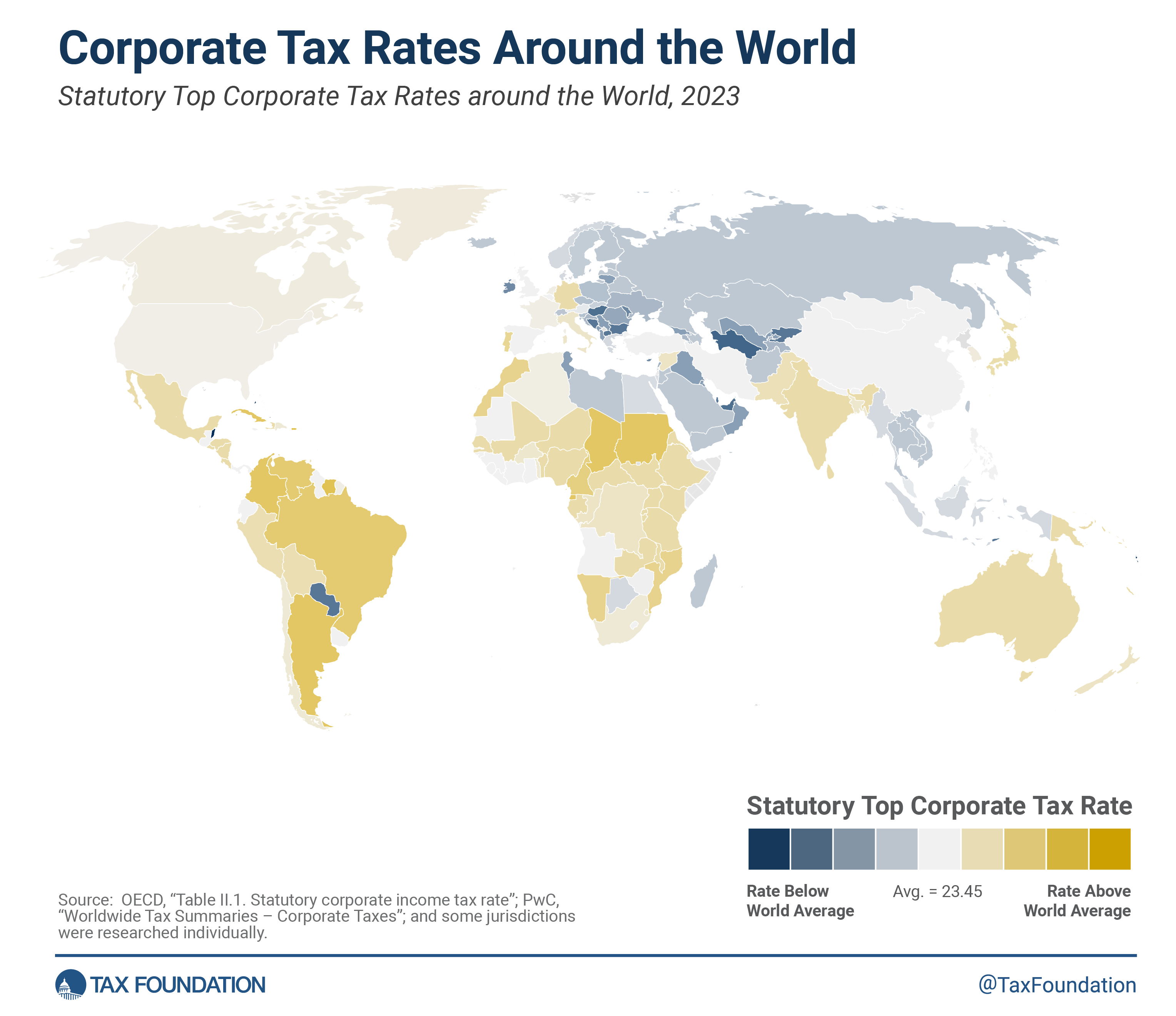

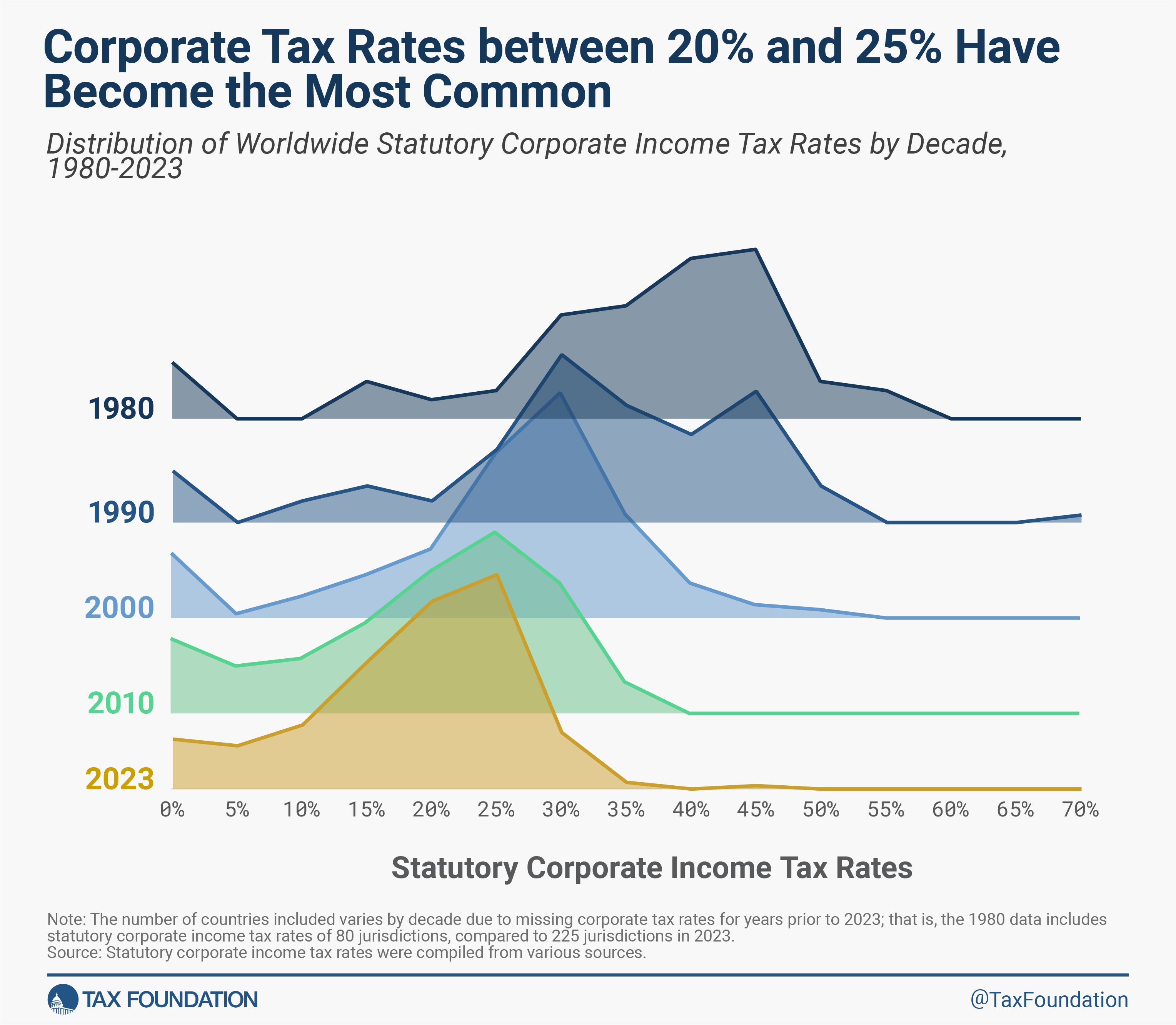

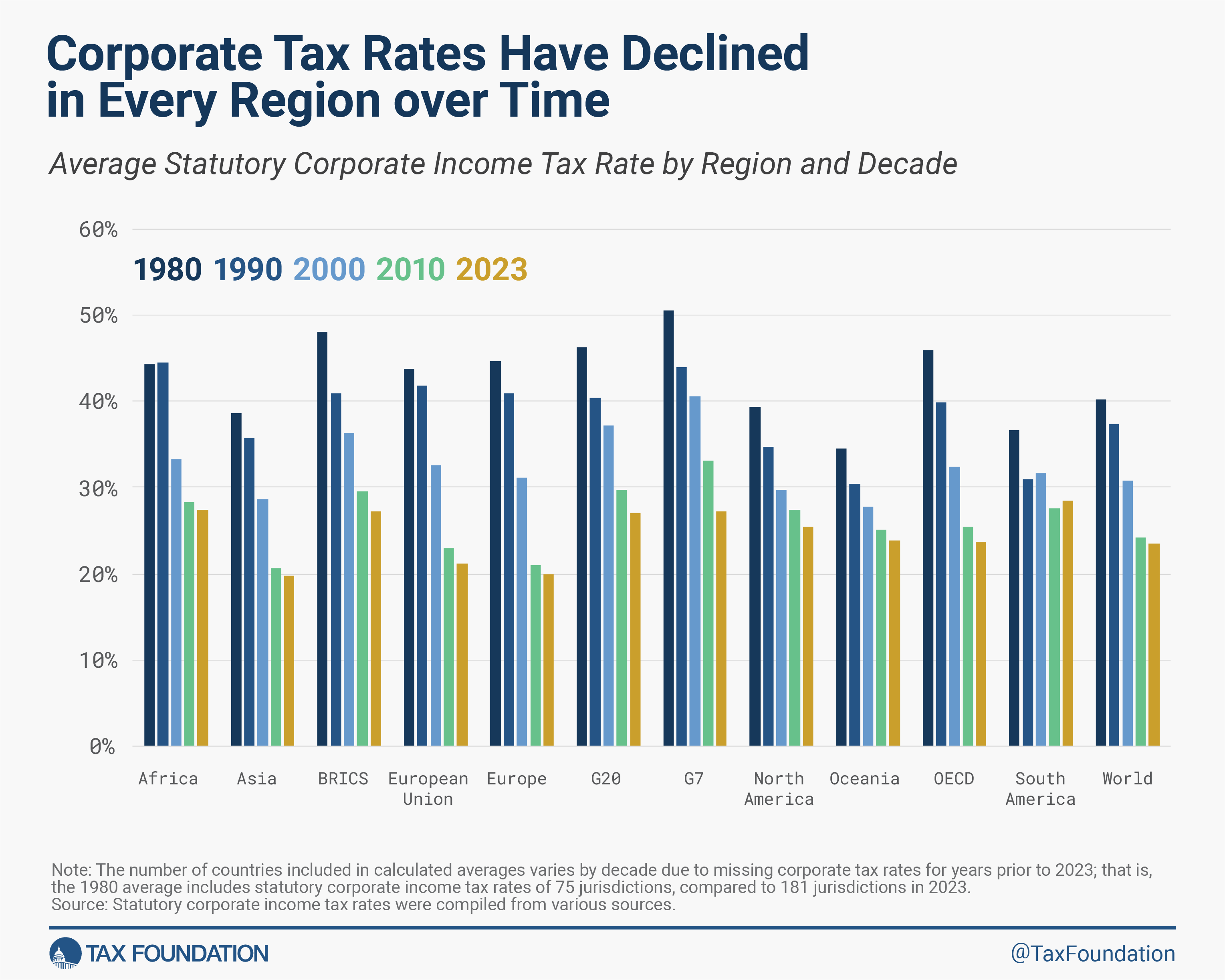

Source : njbia.orgCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comCorporate Income Tax Definition | TaxEDU Glossary

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

Source : itrfoundation.org2023 State Corporate Income Tax Rates & Brackets | Tax Foundation

Source : taxfoundation.orgCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgCompany Income Tax Rate 2024 2024 Corporate Income Tax Rates in Europe | Tax Foundation: REIT dividends are taxed differently than dividends from standard C-Corps, potentially resulting in lower taxes. Click here to read what investors need to know. . Personal Income Tax (PIT) collection is set to exceed Corporate Income Tax (CIT use of Annual Information Statement (AIS), simplification and rationalisation of tax rates, besides others,” he had .

]]>